Understanding the basics of money management can position you to hit your financial goals earlier than expected. Combining smart financial decisions can help you in both the short-term and long-term.

- Buy the right insurance

- Use your credit card utilization

- Don’t forget your taxes

- Keep track of interest rates

- Budget for college early

- Carefully plan when buying a house

- Take advantage of budgeting resources

- Try the 50/30/20 budget rule

- Make smart investments

- Focus on family finances

- Save for the unexpected

1. Buy the right insurance

Insurance can be a great financial defense, whether a natural disaster destroys your home, or your vehicle gets totaled in an accident. However, it’s not uncommon to feel you’re paying too much for the level and type of coverage you receive.

Make sure that you’re properly protected with the right amount of coverage for your home and vehicles. You also may want to consider life insurance if you own a home or have loved ones you want to provide for.

2. Use your credit utilization

A good rule of thumb for credit card spending is to maintain a credit utilization ratio of less than 30%. This is an important factor in your credit scores.

Credit in good standing is important particularly when you’re preparing for major financial decisions like taking out a mortgage or applying for an auto loan.

3. Don’t forget your taxes

Failing to pay your taxes can lead you into financial trouble. Consider making a financial calendar that reminds you when to pay and file your taxes. Here are some ways to save:

- Contribute to a tax-deferred retirement account. Tax-deferred accounts such as a 401(k) or a traditional IRA aren’t taxed until you withdraw funds. As a result, you’ll have years to compound interest on tax-free savings.

- Take matters into your own hands. If you’ve hired someone to do your taxes in the past, consider doing it yourself by using intuitive tax software.

4. Keep track of interest rates

Interest rates are a part of almost any financial move you’ll make. Credit cards, student loans, mortgages and auto loans are just some of the financial accounts you may have that come with an interest rate.

It’s a good idea to know the interest rates on these various types of accounts, because they may be causing you tospend more on your various debt commitments.

If rates have fallen or your credit has improved since you took out a loan, it may be worth considering refinancing your debt.

5. Budget for college early

About 43 million Americans are currently dealing with student loans.

Budgeting and saving for college tuition — whether it’s your own or your child’s — is a key financial tip for avoiding overwhelming debt. If you can’t afford to save for your children’s college tuition, you can open a 529 college savings plan and ask other family members contribute.

Pro tip: If possible, considering opting for an in-state college. On average, in-state students attending a four-year public school pay about 158% less than their out-of-state peers, according to a 2022 College Board study.

6. Carefully plan when buying a house

Taking out a mortgage you can comfortably afford is another important personal financial tip worth considering.

To get a leg up on your home loan, making a down payment of 20% or more is advantageous if you can swing it financially. Although some home loans require as little as 3% down based on your credit history, you’ll want to pay as much upfront as possible.

This strategy may allow for significantly lower mortgage payments, less interest and better mortgage loan options.

7. Take advantage of budgeting resources

Tracking finances without help can be overwhelming. Fortunately, some resources can help you track your income and expenses and make smart financial moves.

Check out Credit Karma’s library of free financial calculators to help estimate how much you may be able to afford for a mortgage, auto loan and more.

8. Try the 50/30/20 budgeting rule

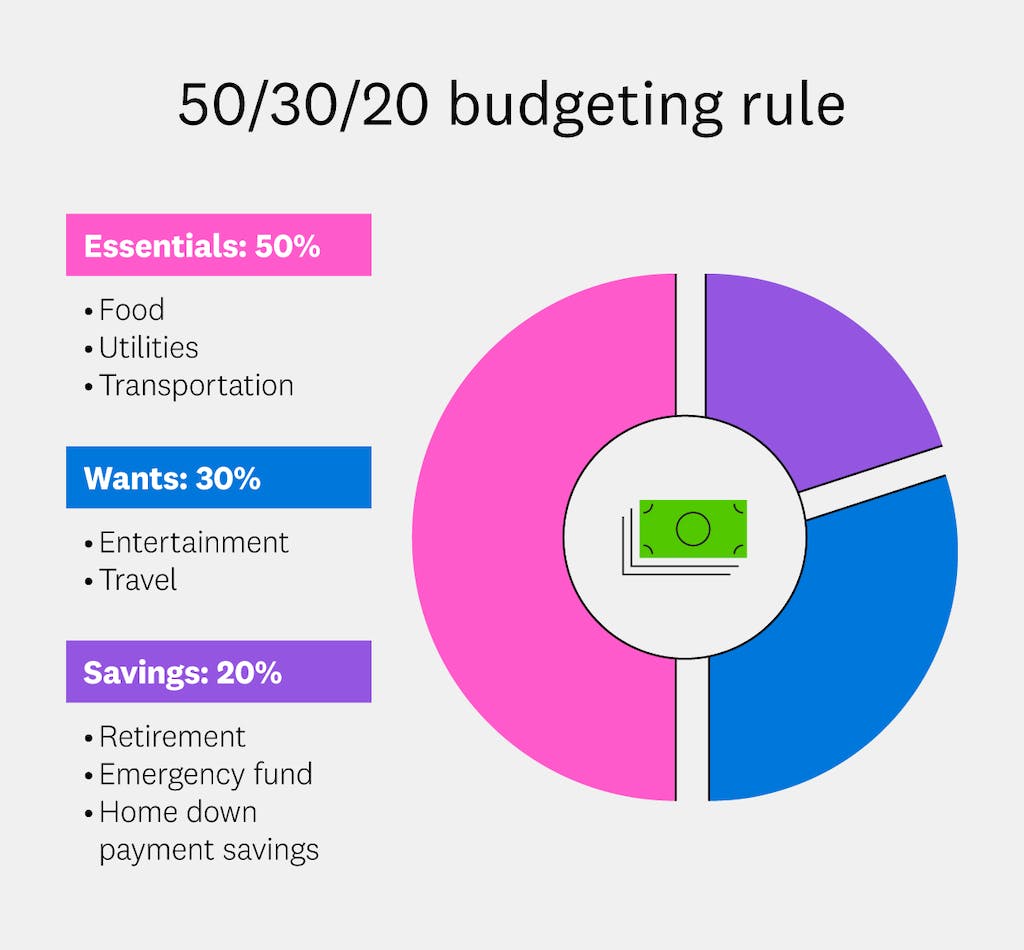

A money management tip is following the 50/30/20 rule, which includes:

- 50% of your income goes toward essentials such as housing, food, transportation and utilities.

- 30% of your income goes toward your wants, such as entertainment and travel.

- 20% of your income goes toward your savings and extra debt repayments, such as retirement savings, emergency fund savings and extra credit card repayments above your minimum due.

Pro tip: Use Credit Karma’s student loan calculator to estimate how much you’ll pay monthly based on several key factors.

9. Make smart investments

Investing can be a great way to boost your future savings. Consider investing in inexpensive index funds or target-date funds, as these are generally considered less volatile and lower risk than investing in specific stocks or other less regulated investments.

Try to max out your tax-advantaged accounts, such as your 401(k) or IRA, before investing in a taxable account.

10. Focus on family finances

Couples merge and manage their finances in various ways. Sometimes, combining funds allow them to plan for major purchases, like:

- Buying a new home

- Saving for a child’s college

- Buying a new car

Couples who intend to spend retirement together can consider their investment portfolio a single asset.

11. Save for the unexpected

It’s smart to have a plan in place should an emergency arise. Fender benders, medical bills and a leaky roof are just some surprises life might throw at you.

To create an emergency fund, set aside a portion of your income in a savings account that you won’t be tempted to touch. It’s recommended to store anywhere between three- and nine-months’ worth of expenses in this fund, depending on your income and lifestyle.